3 April 2020

Your latest regular update. Clarity on the 2-person rules in homes and private properties, JobKeeper Payment traps to look out for, free childcare for workers, members doing the right thing on site and our new Business Endurance webinars ...

We’ve been updating you daily as new information comes to light. We’ll continue to update you as and when new information is available.

This COVID-19 member update is unlocked and free to all in the interests of the building and construction industry. Did you know members have exclusive access to information and our team of experts who are on hand to assist in a range of ways? Need more specific COVID-19 advice relating to contracts, WHS, employment conditions or the relief measures? Members can contact us or learn how to join so you can speak with our experts and get free advice.

Builders & tradies exempt from 2-person rule in homes

The health directive issued last night (2 April) by the Queensland Government confirms that the 2-person rule doesn’t apply to builders and tradies working in the home or private premises.

The directive specifically states that workers are not prevented entering a place of residence and they are not counted as visitors.

This is incredibly important for our industry and means specifically you can still undertake:

- Building or renovation work inside or outside a house

- Maintenance work like plumbing, gas fitting, electrical, etc

- Landscaping work, like lawn, pools, shed installations, etc

- Internal installations like screens, blinds carpet etc

- Meetings to sign a contract, provide quotes, pick colours, etc.

You are able to send as many workers as required to complete work at the premises, but it's imperative you follow the relevant social distancing rules.

For example – if you are performing a kitchen renovation that requires three workers, you can do this as long as you have social distancing and hygiene measures in place.

We also recommend that you:

- Request information about whether people at their premises are healthy and that no one is being quarantined or self-isolating - use our Health disclosure form.

- Advise the client what measures you will be taking to ensure your workers health and safety and the safety of those at the property during your work - use our Notice for private premises clients form.

JobKeeper Payment: don't get caught out

While the federal government's JobKeeper Payment offers a lifeline to businesses most impacted by the Coronavirus, it does not exempt employers from observing workplace relations laws.

With a $1,500 fortnightly lifeline on offer, eligible businesses may now be considering cost cutting measures to capitalise on the opportunity and reduce expenses. But with the fineprint still not yet available until legislation is passed next week, it is important to remember that your usual employment obligations still apply, despite the unprecedented times we are facing.

Reducing hours

If you are eligible, and cannot afford to pay the difference between the JobKeeper Payment and the employee’s usual wage, then you may be considering reducing hours so that the expenses incurred are offset in their entirety by the subsidy you receive. Changes to employment contracts, for example weekly to part-time, need to be carefully implemented.

However, Modern Awards and Enterprise Agreements place a number of obligations on you when doing this, including consulting with, and seeking the agreement of the employee before instigating any such change. A unilateral decision to materially change an employee’s hours of work, or conditions could expose you to a potential termination/redundancy claim.

Alternatively, an employee may be stood down for part of a week. This is subject to rigorous tests, possibly made more so under the JobKeeper Payment (which may improve the employers capacity to usefully employ).

Nominating long term casuals as eligible workers

Whilst the JobKeeper Payment extends to long term casuals (who have at least 12 months service), it is timely for employers to note that long term casuals can request flexible working arrangements and take unpaid parental leave.

For further information regarding any of these topics, please contact our Workplace Relations team or read our common employment FAQs.

Free childcare for workers

The federal government has announced a $1.6 billion childcare package that will provide free childcare from 6 April. This is to accommodate workers and vulnerable families who rely on the service.

If you have un-enrolled your child, you are encouraged to re-start your enrolment knowing that you will not be required to pay a gap fee, even if you choose to not send your child. Re-starting your enrolment will, however, hold your place at the centre once things begin to normalise.

Doing the right thing

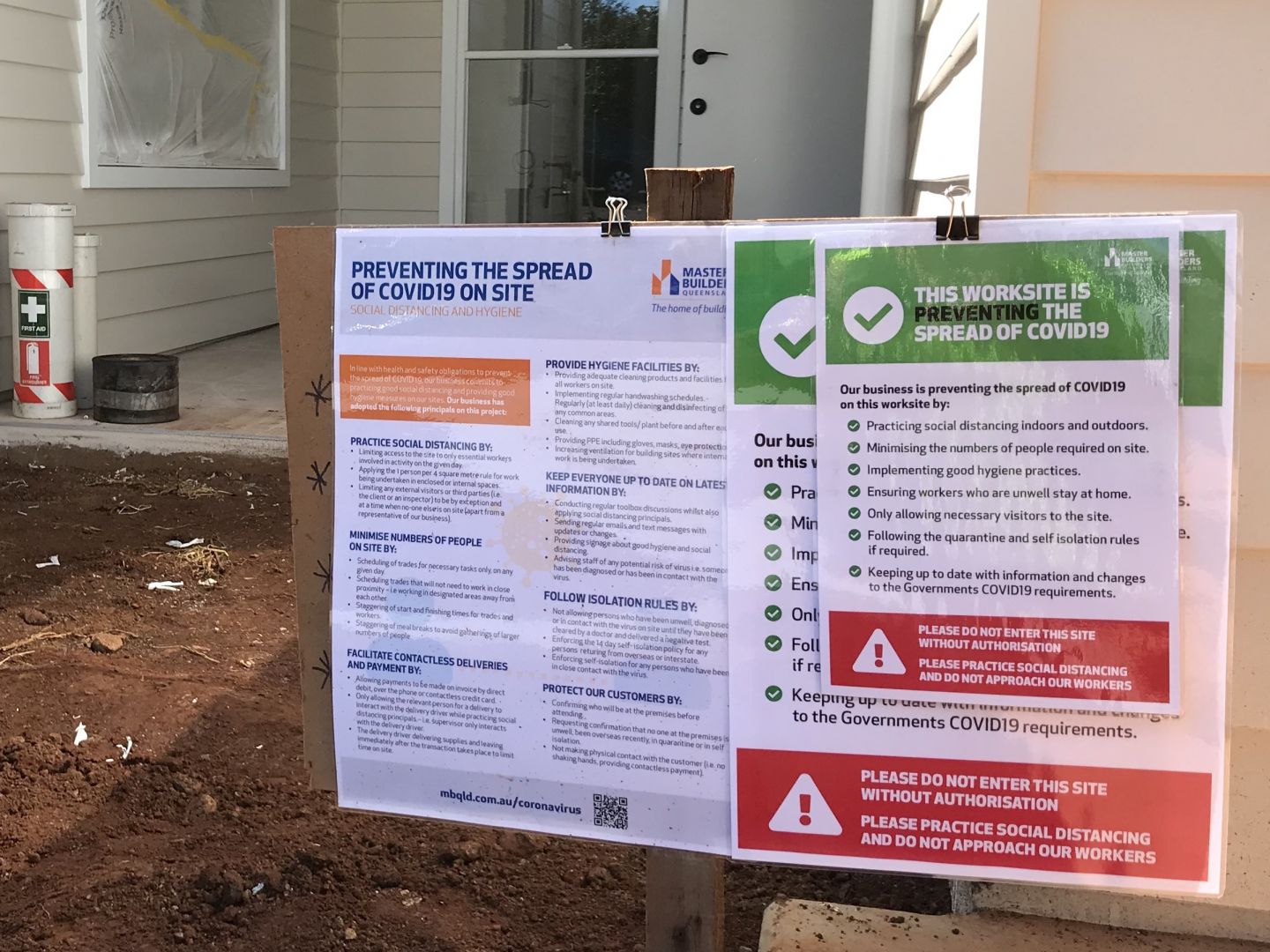

We're hearing of plenty of examples where members are embracing the new social distancing and hygiene rules.

Plenty of you, like this member from regional Queensland, are using the resources we've developed.

Whether you're in SEQ or regional Queensland, it's equally as important to comply, so use our resources like the COVID-19 site sign for educating workers on the new requirements, and the COVID-19 site sign (public) to demonstrate to visitors the measures you have implemented.

Got an example of how you're complying on site? We're keen to show the Queensland Government just how compliant our industry can be and how serious we are about staying open for business and keeping our workers employed.

Tell us about it or let us know of additional resources that might be useful.

Free Business Endurance webinars

We've developed a brand new webinar series covering industry specific topics that relate to keeping your business going during COVID-19.

This free live 45 minute webinar series will provide you with expert advice to help you through COVID-19 business challenges - particularly on topics like finance, HR, IT, contracts and health and safety.

Get expert business financial advice and strategies to help you through these turbulent times. Join Michael Renton, CEO of Xact Accounting, as he shares the information you need on:

- Financial management during the COVID-19 crisis

- Cost control and cashflow strategies, forecasting your cash and debt accumulation

- Government grants and assistance.

Resources

We're trying to make it easier with loads of resources available:

- Health Disclosure Form - use this when visiting clients and private premises

- Notice to supply to clients - use this to confirm for clients you are authorised to attend

- COVID-19 site sign - use this to educate your workers on the guidelines

- COVID-19 site sign (public) - use this to reinforce to the public and workers on the measures you are taking

- Keep your distance checklist - use this to ensure you are following all the recommendations

We're here for you

We've got the information you need on:

- Contractual information for site shutdown or program delays

- How to deal contractually with a product delay

- Safety & hygiene practices

- Employment conditions

- Common employment FAQs

- Relief and stimulus packages

- Mental health and well-being

Help and advice

As usual, our staff are here to help. Whether you've got a question about protecting your business contractually, an employment or a health and safety question, our specialists are here and available to talk you through the options - get in touch.